Bonita Springs pricing looks steadier than most, but the real story is transaction momentum — closed sales growth is leading the region.

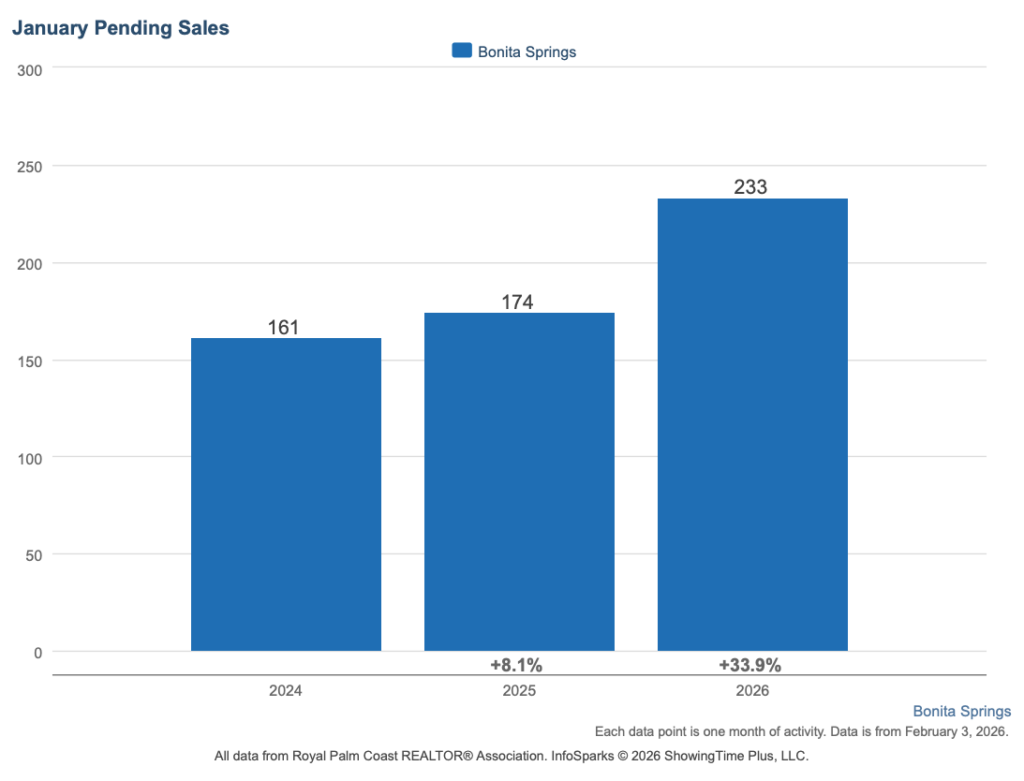

January 2026 data from the Florida Gulf Coast MLS (FGCMLS via Stellar MLS) shows a Bonita Springs real estate market where buyers are returning and inventory is tightening faster than anywhere else in the region. Pending sales rose 33.9% year over year, closed sales increased 10.1%, and months of supply improved from 11.4 to 8.4.

Bonita Springs is the only major Southwest Florida market with a positive year-over-year price headline. But with roughly 120 closings per month compared to 300 or more in neighboring cities, the median can still move based on what sells in any given month. The six-month trailing average shows prices down 3.1% year over year, which is more consistent with broader regional trends. The stability is real, but the headline slightly overstates it.

What the data shows more clearly is activity. Buyers are showing up, sellers are listing fewer homes, and the gap between supply and demand is narrowing faster here than in neighboring cities.

Key Takeaways (TL;DR)

- Buyer activity is rising. Pending sales increased 33.9% year over year to 233, and showings per listing rose 17.9%.

- Closed sales growth leads the region. Bonita Springs recorded 120 closings, up 10.1% year over year, the strongest percentage growth among major SWFL markets.

- Inventory is tightening fast. Months of supply improved from 11.4 to 8.4, a 26.3% improvement, while active listings declined 15.3%.

- Price stability needs perspective. The median price of $567,500 is up 0.4% year over year, while trailing averages show a decline closer to 3.1%, more in line with the region.

- Pricing accuracy varies by community. Re-list rates across featured Bonita Springs communities range from 22% to 48%, with timelines diverging sharply based on initial pricing strategy.

Bonita Springs Compared to Southwest Florida

| Market | Median Price | YoY Change | Closed | Closed YoY | Pending | Pending YoY | Months Supply | Median DOM |

|---|---|---|---|---|---|---|---|---|

| Fort Myers | $350,000 | -7.9% | 306 | -1.3% | 588 | +29.5% | 7.7 | 43 |

| Cape Coral | $352,450 | -3.4% | 322 | +6.3% | 595 | +39.7% | 6.4 | 45 |

| Estero | $530,000 | -13.1% | 95 | +3.3% | 160 | +23.1% | 6.9 | 52 |

| Bonita Springs | $567,500 | +0.4% | 120 | +10.1% | 233 | +33.9% | 8.4 | 47 |

| Naples | $651,000 | -3.6% | 510 | -5.7% | 885 | +22.6% | 8.9 | 59 |

| SWFL Region | $419,950 | -4.6% | 1,852 | 0.0% | 3,276 | +28.2% | 8.1 | 53 |

Bonita Springs stands out for its positive price headline, but the more meaningful signal is transaction momentum. Closed sales growth of 10.1% is the strongest in the region, and pending sales growth of 33.9% is second only to Cape Coral.

For a deeper look at regional trends shaping local markets, see our Southwest Florida Real Estate Market Report – February 2026. To see how this local trend fits into the broader statewide picture, read Florida Housing Ends 2025 Stronger Than Expected (Florida Realtors).

Bonita Springs Market Snapshot

- Median Sale Price: $567,500

- Year-over-Year Price Change: +0.4% (headline) | approximately -3.1% (six-month trailing average)

- Closed Sales: 120, up 10.1% year over year

- Pending Sales: 233, up 33.9% year over year

- Months of Supply: 8.4

- Median Days on Market: 47 days

Buyer interest in Bonita Springs is picking up, but conditions still allow for careful decision-making. Homes are spending more time on the market than they did during the peak, which has shifted how buyers approach the search. Buyers looking at homes for sale in Bonita Springs are taking the time to compare communities and pricing, while homes priced in line with recent comparable sales are the ones getting the most activity.

Supply and Demand in the Bonita Springs Housing Market

Bonita Springs inventory has tightened faster than any other major Southwest Florida market over the past year.

Months of supply declined from 11.4 to 8.4, a 26.3% improvement. Active listings fell 15.3% year over year, and new listings dropped 24.2%, the sharpest seller pullback among the markets we track.

At the same time, buyer engagement increased. Pending sales rose 33.9%, closed sales climbed 10.1%, and showings per listing increased 17.9%. Rising demand meeting reduced new supply explains why Bonita Springs is tightening faster than neighboring markets still working through elevated inventory.

Even with this improvement, 8.4 months of supply still gives buyers choice, which keeps pricing grounded.

Pricing Trends in Bonita Springs

The median sale price of $567,500 is up 0.4% year over year, the only positive headline among major SWFL cities. With roughly 120 monthly closings, individual months remain more sensitive to which homes happen to sell than higher-volume markets.

Over the past twelve months, prices ranged from approximately $485,000 to $590,000. The six-month trailing average shows prices down 3.1%, reflecting timing and sales mix rather than a sudden change in direction.

The market peaked in May 2024 at $692,000. The current median sits about 18% below that high, while remaining roughly 57% above January 2021 levels. Long-term appreciation remains intact for most owners.

Improving demand has not eliminated the importance of pricing discipline for Bonita’s sellers.

Homes priced above recent comparable sales continue to face longer timelines, even as buyer activity improves. Community-level data highlights the difference between alignment and resistance.

Bonita Springs Featured Communities

Village Walk of Bonita Springs

• Recent Activity: 20 sales in the past 120 days

• Pricing: Median sold $481,250 | Range $395,000–$820,000

• Home Types: Single-family homes and villas

• Market Snapshot: 5.6 months of supply | 25-day median DOM | 97.3% sale-to-list

Village Walk of Bonita Springs is operating with the tightest inventory among Bonita Springs featured communities at 5.6 months of supply. Homes are moving quickly, with a 25-day median DOM and sales averaging 97.3% of list price. Among current listings, 25% previously came off market and returned, and those re-listed homes are selling faster than fresh listings (28 vs 48 days), suggesting pricing adjustments are helping sellers align with buyer expectations.

Search homes for sale in Village Walk of Bonita Springs to compare current available inventory.

Bonita National

• Recent Activity: 24 sales in the past 120 days

• Pricing: Median sold $580,000 | Range $331,000–$1,225,000

• Home Types: Condos, coach homes, and single-family homes in a golf community

• Market Snapshot: 7.7 months of supply | 48-day median DOM | 97.2% sale-to-list

Bonita National continues to show steady transaction volume, with 24 sales over the past 120 days. The 97.2% sale-to-list ratio reflects modest negotiation. Among current listings, 22% previously came off market and returned, the lowest re-list rate among Bonita Springs featured communities, indicating sellers are generally pricing in line with market expectations on initial listing.

Explore homes for sale in Bonita National to see how current pricing compares to recent sales.

Spanish Wells

• Recent Activity: 17 sales in the past 120 days

• Pricing: Median sold $575,000 | Range $220,000–$980,000

• Home Types: Condos, villas, and single-family homes in a golf community

• Market Snapshot: 7.8 months of supply | 94-day median DOM | 93.8% sale-to-list

Spanish Wells is experiencing longer timelines, with a 94-day median DOM, and the 93.8% sale-to-list ratio points to more active negotiation. Among current listings, 27% previously came off market and returned. The wide price range reflects the community’s diverse mix of condos, villas, and single-family homes.

View homes for sale in Spanish Wells to understand current inventory and pricing trends.

Valencia Bonita

• Recent Activity: 12 sales in the past 120 days

• Pricing: Median sold $925,000 | Range $524,000–$1,550,000

• Home Types: Single-family homes in an active adult community

• Market Snapshot: 9.7 months of supply | 17-day median DOM | 97.3% sale-to-list

Valencia Bonita shows the fastest median DOM among Bonita Springs featured communities at 17 days, with homes selling at 97.3% of list price. Among current listings, 31% previously came off market and returned. Re-listed homes are moving significantly faster than fresh listings (25 vs 105 days), indicating that pricing adjustments are proving effective.

Search homes for sale in Valencia Bonita to explore current 55+ community inventory.

Pelican Landing

• Recent Activity: 47 sales in the past 120 days

• Pricing: Median sold $850,000 | Range $215,000–$3,550,000

• Home Types: Condos, villas, and single-family homes across multiple neighborhoods

• Market Snapshot: 11.9 months of supply | 39-day median DOM | 94.2% sale-to-list

Pelican Landing posted the highest sales volume among Bonita Springs featured communities with 47 transactions. Inventory levels remain elevated at 11.9 months of supply, and 37% of active listings previously came off market and returned. Fresh listings are moving faster than re-listed homes (75 vs 90 days), reinforcing the value of early pricing alignment.

Explore homes for sale in Pelican Landing to compare listings across the community’s diverse neighborhoods.

Seasons at Bonita

• Recent Activity: 7 sales in the past 120 days

• Pricing: Median sold $630,000 | Range $460,000–$880,000

• Home Types: Single-family homes

• Market Snapshot: 12.0 months of supply | 140-day median DOM | 94.7% sale-to-list

Seasons at Bonita is operating with elevated inventory at 12.0 months of supply and longer timelines, reflected in a 140-day median DOM. Among current listings, 48% previously came off market and returned, the highest re-list rate among Bonita Springs featured communities. With only 7 closed sales in the lookback period, individual transactions carry greater influence on market metrics.

View homes for sale in Seasons at Bonita to evaluate pricing relative to recent buyer activity.

What Bonita Springs Buyers and Sellers Want to Know Right Now

Bonita Springs experienced much of its adjustment earlier than Estero or Naples, peaking in mid-2024 and giving back a portion of those gains ahead of other markets. The positive year-over-year figure also reflects variability that comes with smaller monthly transaction volume. Trailing averages show prices down 3.1%, more in line with regional trends.

Pricing alignment and community type. Active adult and golf communities priced close to recent sales, such as Village Walk and Valencia Bonita, are moving faster. Communities with higher re-list rates and elevated inventory are taking longer. The product matters, but pricing matters more.

Bonita Springs offers a lower entry point, with a $567,500 median compared to $651,000 in Naples, while showing stronger transaction momentum. Closed sales are up 10% in Bonita Springs versus down 6% in Naples.

Even after the post-peak adjustment, prices remain approximately 57% above January 2021 levels. Most owners who purchased before 2022 still hold meaningful equity.

Insurance is part of nearly every transaction conversation, especially for older homes and properties in flood-prone areas. With FEMA flood map reviews ongoing in Lee County and revisions expected later this year, buyers are asking detailed questions earlier. Sellers who provide documentation upfront are seeing smoother closings.

Final Thoughts

Bonita Springs is showing a clear shift in direction. The market that had the highest months of supply a year ago is now tightening faster than any other in Southwest Florida. Transactions are up, new supply is down, and pricing has stabilized after an 18% adjustment from peak levels.

For buyers, Bonita Springs offers choice across a wide range of price points and community styles. For sellers, pricing accuracy continues to determine outcomes.

Most homeowners feel overwhelmed when it is time to move. At Worthington Realty, we provide personalized guidance and clear communication so you feel heard, valued, and confident in your decisions.

Methodology: This report draws from Florida Gulf Coast MLS data, including InfoSparks aggregate statistics from January 2021 through January 2026, transaction-level analysis of featured Bonita Springs communities, and a re-list review identifying properties that previously expired, terminated, or withdrew within the past 12 months. Trailing averages are used where appropriate to reduce volatility associated with Bonita Springs’ smaller monthly transaction volume.