If you’re buying a home in Lee County and want to avoid paying for flood insurance, you’re not alone. Many buyers ask us, “Where do we need to be if we don’t want to pay for flood insurance?”. It’s a common question, but there’s a difference between avoiding the requirement and avoiding the risk. If you’re a homebuyer trying to make sense of all the flood zones and loan rules, this guide is for you. We’ll walk through what triggers mandatory flood insurance, how FEMA flood zones work, how to check a property’s flood zone, and where in Lee County you’re more likely to find homes that don’t require it.

Key Takeaways (TL;DR)

- To avoid mandatory flood insurance, look for homes in Zone X, Zone B, Zone C, or Zone D.

- Lenders require flood insurance if the home is in a zone like Zone A, AE, or VE and you’re using a federally backed mortgage.

- Zone X means lower risk, not no risk. About 40% of flood claims come from outside areas with required coverage.

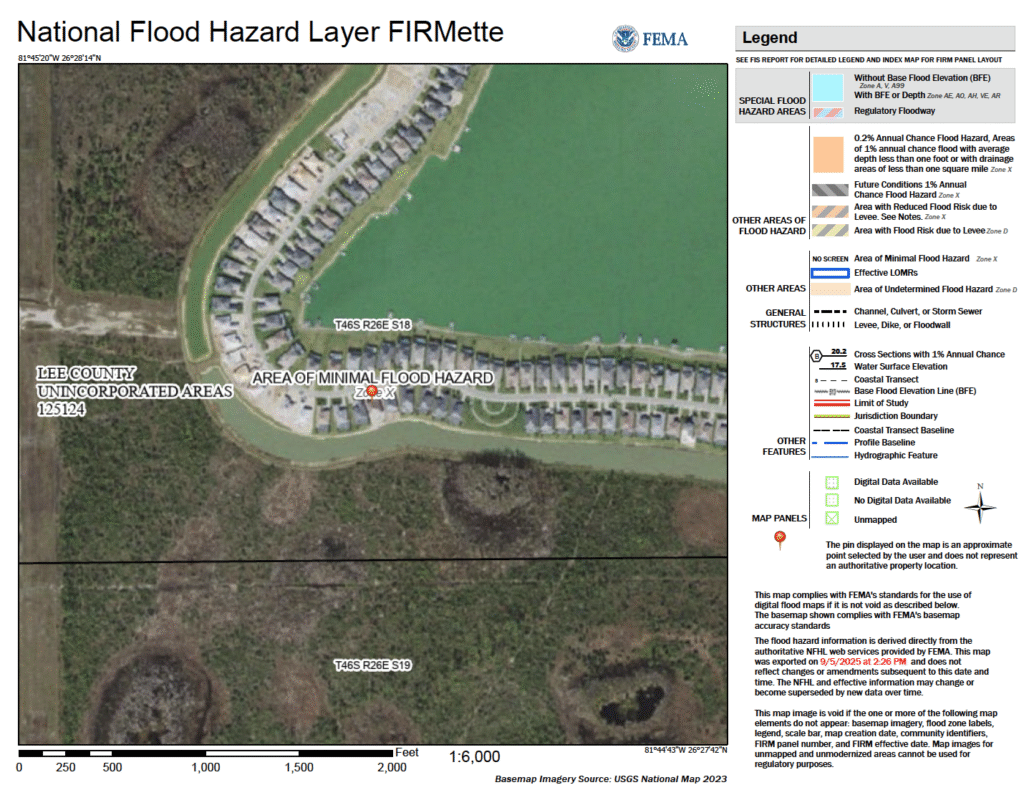

- You can check any property’s flood zone using the LeeGIS flood zone tool or FEMA’s map service.

What Triggers Flood Insurance Requirements?

Flood insurance becomes mandatory when two things are true: the home sits in a FEMA-designated Special Flood Hazard Area (SFHA), and the buyer uses a federally backed loan. FEMA designates zones labeled A, AE, VE, AH, AO, and others as areas with a 1% or greater annual chance of flooding.

If you’re financing your home with an FHA, VA, USDA, or most conventional loans, and the property is in one of those zones, lenders require flood insurance as a condition of the loan. If you’re paying cash, you don’t have to carry flood insurance, though it’s still worth evaluating the risk.

Homes in lower-risk zones, like Zone X or D, don’t trigger this requirement. That’s what makes those areas attractive to buyers looking to avoid the extra cost.

Understanding FEMA Flood Zones

FEMA uses flood zones to indicate the level of flood risk for a given property. The zones are based on historical flood data and elevation. Zones that begin with “A” or “V” are officially classified as Special Flood Hazard Areas (SFHAs), meaning they carry a 1% or greater annual chance of flooding. Many experts call these areas the 100-year floodplain.

Zone AE appears frequently in Lee County and covers areas where FEMA has measured flood elevations. Zone A carries a similar level of risk, but FEMA has limited elevation data for those areas. Zones VE and V apply to coastal properties that face added risks from wave action and storm surge. Zones AH and AO mark areas where water pools or flows shallowly during a storm.

If you’re searching FEMA flood maps for Fort Myers or any other part of Lee County, these are the designations to pay the most attention to.

What About Zone D?

Zone D differs from other designations because FEMA hasn’t completed a full study for those areas. The risk exists but remains undefined. Lenders don’t require flood insurance in Zone D, but the uncertainty makes some buyers avoid it while others weigh it against the property’s location and elevation.

Now that we’ve covered the zones where lenders often require insurance, or where risk is unclear, let’s look at the zone many buyers specifically ask us about: Zone X.

What Is Zone X and Why Buyers Want It

Zone X properties are outside the Special Flood Hazard Area. Even with a federally backed mortgage, lenders don’t require flood insurance in Zone X.

Unshaded Zone X properties are at the highest elevation and least likely to flood, according to FEMA data. Shaded Zone X properties carry a slightly higher risk but are still outside the 1% annual flood zone.

From a buyer’s standpoint, Zone X means lower overall risk and lower insurance costs. In fact, many homeowners in Zone X opt into flood insurance anyway, because policies in these zones are inexpensive and can offer peace of mind.

If you’re searching for homes for sale in Zone X Fort Myers neighborhoods, a custom search using GIS tools or your agent’s MLS access is the best way to narrow your options.

Where to Buy Lee County Homes Without Flood Insurance

So where are buyers actually finding homes that don’t require flood insurance? While buyers must check each property individually, some Fort Myers neighborhoods contain more Zone X homes than others. Here are a few of the busiest single-family communities over the last 12 months.

San Carlos Park

San Carlos Park is a popular Fort Myers neighborhood known for its affordability and no-HOA lifestyle. Many homes here fall in Zone AE, where lenders typically require flood insurance with a mortgage.

Gateway

Located in eastern Fort Myers, Gateway offers a mix of established homes and new developments. Many of the newer sections fall in Zone X, where flood insurance usually isn’t required. Zoning can vary within the community, so confirming by address is key.

Portico

Portico is a newer gated community in southeast Fort Myers with lakefront views and modern amenities. Much of the neighborhood falls in Zone X, which appeals to buyers looking to avoid added insurance costs.

The Plantation

The Plantation Golf & Country Club in Fort Myers features homes built at higher elevations. Most areas fall within Zone X, making it an appealing option for buyers focused on minimizing flood insurance concerns.

WildBlue

WildBlue spans Fort Myers and Estero and is centered around a series of lakes. The community was designed with elevation in mind. Many properties are in Zone X, though lakefront lots should still be confirmed individually.

Timber Creek

Timber Creek is a master-planned community east of I-75 with resort-style amenities. Most homes are in Zone X, but recent development patterns and topography mean it’s still important to check specific addresses.

Pelican Preserve

Pelican Preserve is a 55+ gated community in Fort Myers with extensive water features and landscaping. The majority of homes are in Zone X, but lake-adjacent properties may vary slightly.

Mirror Lakes

Mirror Lakes sits inland near the Lehigh Acres area and contains many homes in Zone X. Its inland location offers elevation benefits, but canal proximity and stormwater runoff areas can impact certain lots.

Verandah

Verandah is a gated golf course community along the Orange River. While many homes are located in Zone X, those directly adjacent to the river or low-lying areas may fall into Zone AE. Verifying by property is especially important here.

Esplanade Lake Club

This upscale community near Alico Road surrounds a private lake and offers new construction homes. Most fall within Zone X, though waterfront premium lots should be double-checked for flood designation.

How to Check a Property’s Flood Zone in Lee County

The best tool for local flood zone information in unincorporated Lee County is the LeeGIS flood zone map. You can search by address and view the FEMA flood zone, base flood elevation, and official FIRM panel number.

For properties within city limits like Fort Myers, Cape Coral, or Bonita Springs, FEMA’s Map Service Center may be more accurate.

For a broader view, or to double-check the data, use the Lee County Property Appraiser’s GeoView tool or the LeeGIS Maps Hub.

If you need official documentation—for example, for a lender—you can request a FIRM letter directly from Lee County Community Development at (239) 533-8585 or FIRMInfo@leegov.com.

Should You Still Get Flood Insurance in Zone X?

That depends on your comfort with risk. While Zone X means you’re not required to carry flood insurance, it doesn’t mean a flood can’t happen. FEMA reports that a significant percentage of flood claims come from properties outside areas with required coverage.

Preferred Risk Policies for Zone X homes are typically affordable. They can offer coverage starting around a few hundred dollars per year, depending on the location and elevation. And considering the average flood claim payout is well over $30,000, some buyers decide it’s worth the added protection.

It’s not required, but it’s worth considering.

Frequently Asked Questions (FAQs)

No, flood insurance is not required in Zone X, even with a federally-backed mortgage. Zone X properties are outside FEMA’s Special Flood Hazard Area, meaning they have less than a 1% annual chance of flooding. However, many Zone X homeowners still choose to purchase flood insurance because Preferred Risk Policies can cost as little as a few hundred dollars annually, while the average flood claim exceeds $30,000.

Flood insurance is mandatory for federally-backed mortgages (FHA, VA, USDA, and most conventional loans) in zones A, AE, AH, AO, VE, and V. These are FEMA’s Special Flood Hazard Areas with a 1% or greater annual flood chance. Zone X, Zone B, Zone C, and Zone D do not require mandatory coverage, though private lenders may still require it at their discretion.

For unincorporated Lee County properties, use the free LeeGIS flood zone tool at leegis.leegov.com/floodzone. For incorporated cities like Fort Myers, Cape Coral, or Bonita Springs, use FEMA’s Map Service Center at msc.fema.gov or contact the city directly. The 2022 flood map updates mean some properties may have different zones than older listings show, so always verify with current tools.

Zone AE requires flood insurance with federally-backed mortgages because it has a 1% annual flood chance (100-year floodplain). Zone X does not require insurance because it has less than 0.2% annual flood risk (500-year floodplain or higher). A typical Zone AE flood policy costs $800-$1,500+ annually, while Zone X Preferred Risk Policies often cost under $500 annually.

Yes, private lenders can require flood insurance in any zone, including Zone X, as part of their lending criteria. While federal law only mandates coverage in higher-risk zones, lenders may impose additional requirements for their own risk management. This is more common with portfolio lenders or in areas with recent flooding history. Always confirm requirements with your specific lender during pre-approval.

Final Thoughts

If your goal is to find Lee County homes without flood insurance, Zone X is where you want to be. But the best move is understanding why the requirement exists and what level of risk you’re truly comfortable with. If you want to see what’s on the market right now, browse the latest Southwest Florida homes for sale.

For a broader view across the region, see our full Southwest Florida September 2025 Housing Market Update.

Most homeowners feel overwhelmed when it’s time to move. Schedule a call with us today and get personalized guidance and clear communication so that you feel heard, valued, and confident in your decisions.

See our About Us page to learn how we do things a little differently.